credit accident insured car insure

credit accident insured car insure

Generally, the majority of people believe that smaller automobiles such as cars are extra maneuverable as well as, thus, more probable to trigger crashes. Have a peek at this website This is also backed up by stats that show smaller sized and sportier vehicles are driven at higher rates and by younger, riskier chauffeurs. So, because these cars are likely to be associated with more mishaps, they also come to be more costly to guarantee. insure.

cheaper insure car insurance credit score

cheaper insure car insurance credit score

The result is millions of dollars getting lost in vehicle damages, which insurance provider finish up paying by means of the comprehensive plan, says Mc, Clain Insurance Coverage Solutions. According to NOAA, the general damage triggered by floods, twisters, as well as hailstorms is even more than $9. 5 billion annually. It's apparent that insurance solution suppliers are indeed paying out.

Without insurance Chauffeurs, Of training course, getting automobile insurance policy protection is the ideal point to do. Unfortunately, not everyone makes the initiative to get coverage - insurers. According to a record by the Insurance Study Council, the rate of vehicle drivers without this critical policy boosted from 12. 3 percent in 2010 to 13 percent in 2015.

7 percent. The Insurance Study Council even includes that uninsured claims passed the$2 billion as of 2012. The typical repayment by a solitary uninsured motorist likewise stands at $20,000. So it appears that insurance companies endure massive losses when trying to deal with without insurance insurance claims (cars). For the customer, it is the plan proprietor's obligation to carry the worry.

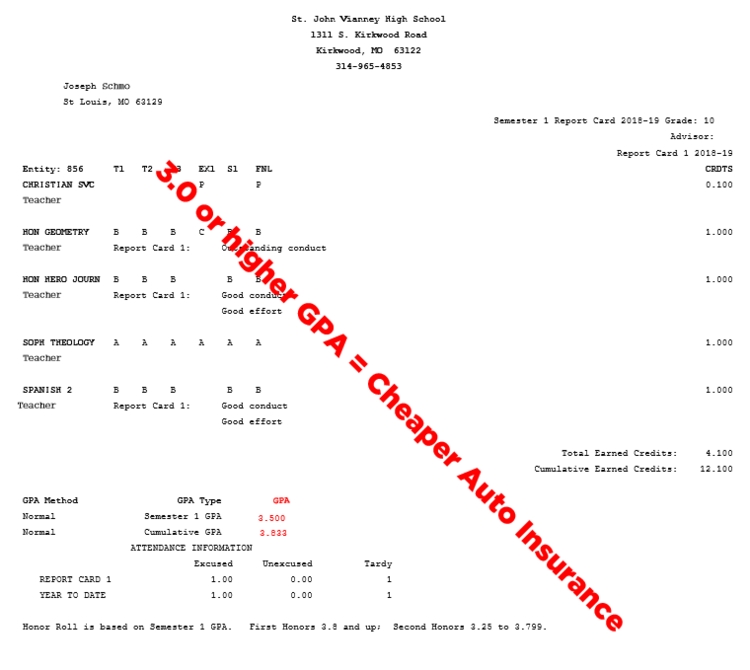

A Reduced Credit History, It's the international practice for loan providers to assess your credit rating score prior to establishing your funding repayment capacity. And as it turns out, the pattern is currently widespread in the auto insurance area. The insurance coverage companies have actually ended that customers with reduced credit rating are much more most likely to be associated with mishaps. car insurance.

Thankfully, states like California bar insurer from utilizing a customer's credit rating to set the costs rates. You have one more solid reason to enhance your credit rating rating. Much more Drivers on The Road, The most evident reason that a lot more crashes are taking place results from people driving a lot more.

The Single Strategy To Use For 5 Causes Of Insurance Premium Increases - Nationwide Blog

Insurance policy experts around the globe also assert that people are driving a lot more miles many thanks to the boosting economic situations. Also those that are unemployed can easily drive currently. In other words, a lot more driving can indicate more crashes and also more prices throughout the board. Save Yourself, Even with these elements at play, you should not pay a penny much more for your cars and truck insurance if you're not comfy with the numbers.

Some people decide for responsibility instead of complete coverage, increasing deductible, and of training course, checking out the terms meticulously - auto. Information and also research in this article validated by ASE-certified Master Service Technician of.

Sources: This web content is created as well as preserved by a 3rd party, and imported onto this web page to aid individuals give their email addresses (business insurance). You might be able to locate more info regarding this and similar content at.

The pandemic sparked a change in the world of vehicle insurance policy. 4 billion in reimbursements, car insurance coverage revenues raised as fewer Americans drove and also the number of vehicle insurance claims went down. cars.

Below's why prices could increase as well as how you can find inexpensive vehicle insurance if they do. Boosted demand from vehicle drivers and also a semiconductor lack has actually made new as well as previously owned automobiles much more expensive, as well as it's anticipated to add to an increase in rates this year, according to a study from Swiss Re Institute, the research-focused department of Swiss Re Group, among the largest reinsurance companies in the globe.

credit score laws insurance company cheap

credit score laws insurance company cheap

This boosted cost ways much more costly cases for insurance firms, as well as insurance claims are currently expected to go back to pre-pandemic numbers this year. Furthermore, there's a grease monkey shortage. There was a sharp decline in the variety of working mechanics in 2020, according to a research of vehicle specialist supply-and-demand from Tech, Force Structure, a not-for-profit that offers resources to aspiring car specialists (vehicle insurance).

What Does Why Is My Car Insurance So High? - Investopedia Do?

Vehicle crashes triggered by distracted driving have actually gotten on the surge for many years (prices). While phone usage is an usual distraction, chauffeurs are additionally reading, eating, using make-up or busied with their kids while behind the wheel. low-cost auto insurance. Distracted driving created 9% of fatal auto accident in 2019, according to one of the most recent data available from the National Highway Website Traffic Security Management.

Chauffeurs show up to additionally be speeding up more given that the pandemic started, which indicates a higher possibility of automobile crashes. A study of 500 united state chauffeurs done by Erie Insurance coverage located that one in 10 vehicle drivers stated they drove much faster than regular at the start of the pandemic. In truth, speeding has become such a trouble that campaigns have actually been launched in Maryland and also Virginia to develop speed-reduction methods that can be applied across various other states.

Of the states that did see rate boosts, the typical yearly boost was $83, a bit more than 5% over 2020 rates. The nationwide consumer-price index for motor car insurance coverage saw a decrease of 3. If you do see a cost rise in your vehicle insurance coverage, you have choices: Insurance firms commonly provide price cuts for things like obtaining your expense through e-mail, taking a defensive driver program or being a constantly safe chauffeur.

, which is commonly the cheapest auto insurance alternative. While you shouldn't cut coverage just to conserve cash, you can go down comprehensive and also crash protection if you drive an older car, as they pay out only up to the current market worth of the cars and truck minus your deductible. Buying around for new vehicle insurance quotes is usually the very best way to conserve.

Nerd, Purse suggests shopping around at the very least when a year to assure you're getting the most effective bargain. Ben Moore creates for Geek, Budget - accident. Email:.

The Best Guide To Why Has My Car Insurance Gone Up? - Car.co.uk Faqs

insurance companies car insurance car

insurance companies car insurance car

Wondering why your vehicle insurance policy went up? Right here are one of the most typical reasons for auto insurance policy premium rises. Has something caused you to wonder, Why did my automobile insurance policy increase? You'll find out in this post there are numerous factors cars and truck insurance goes up. You can control a few of these factors, like: You can't control various other typical factors for auto insurance coverage price rises, however, such as: Besides learning why vehicle insurance provider increase your prices, you'll additionally discover how to lower your automobile insurance coverage costs after they increase.

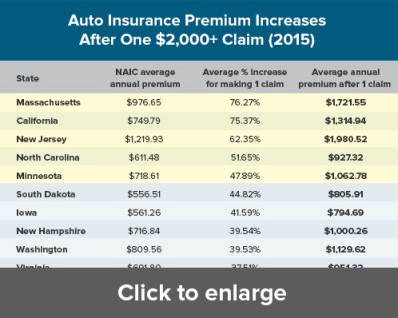

In numerous cases, it ends up being less expensive than filing a claim. That's since cases stay on your insurance document for 3 years in many states.

If you recently obtained right into a crash, that might be why your vehicle insurance policy went up., specifically if you've obtained even more than one in the last couple of years, or if the ticket or citation was for something serious.